Written by Kevin P. Gilmore

From the Director

Haga clic aquí para ver esto en español

Major changes that focus on improving the retirement readiness of active Nazarene ministers will become effective in 2024. This article introduces the new 403(b) matching program and explains how to make the most of it.

Major changes that focus on improving the retirement readiness of active Nazarene ministers will become effective in 2024. This article introduces the new 403(b) matching program and explains how to make the most of it.

If you plan to rely solely on Social Security and P&B-provided benefits as primary sources of income in retirement, you will fall short of what you need. The distributions provided by these programs are designed to supplement, not substitute for, retirement savings. You must also be actively engaged in planning for and contributing to your own retirement.

A 2015 study revealed 74% of Nazarene pastors would not be able to retire before age 73. A more recent study showed 59% of Nazarene lead pastors (excluding bivocational), and 67% of their churches, are not actively contributing to the pastor’s Nazarene 403(b) retirement account. This is a major problem that continues to perpetuate the lack of retirement readiness for many of our pastors. The changes coming in 2024 have been strategically designed to address this situation and provide incentives for improving the savings behavior of our pastors and their churches.

For church years ending in 2023, Annual Pension Supplement (APS) contributions to the 403(b) accounts of ministers will continue as usual, with APS Base/Bonus contributions deposited in 2023 and the Match portion deposited in January 2024.

Beginning in January 2024, the APS Base/Bonus and Match system will be replaced by a new program where P&B contributions will be based solely on the local effort toward the minister’s 403(b) account. “Local effort” refers to the amounts contributed by the minister and/or their church to the pastor’s 403(b) account. The rate of match will be based on the percentage of the church’s P&B Fund allocation paid. Additionally, the requirement to pay 100% of the educational allocation will be eliminated.

For pastors who received a Match under the APS program in 2022, P&B contributed an average total benefit of $795 (including the APS Base/Bonus). Under this new program, these same pastors who meet the maximum matching requirements would earn a P&B-provided benefit of $2,500. That’s more than three times the 2022 average.

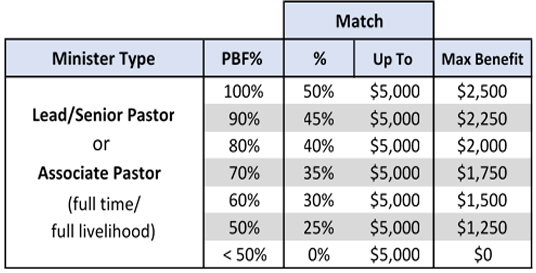

The table below demonstrates the maximum annual 403(b) contribution benefit possible (Max Benefit) based on a local church meeting its P&B Fund goal (PBF%). For churches who pay 100% of their P&B budget, and the church/pastor contribute a total of $5,000 to the pastor’s 403(b) account, the pastor will receive a match of $2,500 (50% x $5,000). If local effort is $3,000, the pastor will receive a matching benefit of $1,500 (50% x $3,000).

We focused on several goals in developing this new matching strategy. First, was an engagement goal to increase the local effort in contributions to the pastor’s 403(b) retirement account. With the new program, if there is no local effort there will be no match. It does not matter if the local effort comes from the pastor, the church, or both—we will simply match however much is contributed (up to the program maximum). Only local effort will be matched, so, for the optimal benefit, the pastor and church should work together to contribute to the account.

The financial incentive goal will be met by a threefold increase to the average benefit.

The benefit improvement goal will be met in several ways. First, is the substantial increase in average benefit paid to those who meet the requirements. Second, the benefit will be contributed in quarterly installments instead of annually, based on the level of local effort each quarter. Finally, the performance measure of the percentage of P&B budget paid will utilize the higher of the most recently closed church year or the prior five-year’s average. This means a pastor’s retirement benefit will not be penalized should a church have an unexpected financial challenge in one year and be unable to pay 100% of its P&B budget.

Finally, the simplicity goal will be met through the elimination of the complicated current APS program and the requirement that education budgets be 100% paid. The benefits table is straightforward and simple to understand.

Our goal at P&B USA is to assist every active Nazarene minister in maximizing their P&B-provided benefits to allow them to retire at the time of their choosing and with the collective resources necessary to support their chosen lifestyle. We believe this new approach will serve us well in these endeavors.

Kevin P. Gilmore serves as executive director of Pensions and Benefits USA for the Church of the Nazarene.