Written by Kevin P. Gilmore

In one of my devotional books the final section focuses on the subject of wisdom, for which the authors state the following:

In one of my devotional books the final section focuses on the subject of wisdom, for which the authors state the following:

“Wisdom is elusive, and it seems to be in short supply. It is not merely a matter of information or knowledge, but of skillful and practical application of the truth to the ordinary facets of life.

The long-range view is a basic tenet of wisdom. The fool lives in the present moment while the sage considers the long-term consequences of present action.

Wisdom calls. Some listen. Some don’t. What [person] in [their] right mind would not want such a priceless tool?” (Boa, Buzzell, & Perkins, God’s Words of Life for Leaders, 1999, pp. 204-5).

It’s a bit intimidating to address the subject of wisdom for fear an audience may think you have somehow cornered the market on the topic, so let me assure you that is not the case. However, the quote here contains much wisdom. In our human condition we often know what we need to do or avoid, but don’t act accordingly, especially when it comes to our finances. We do this because it’s easier to focus on present circumstances and seek gratification now than to postpone gratification for a future that seems so far away.

Our society conditions us this way. Many people don’t save for major purchases, they simply put it on credit—almost without thought—because sellers and lenders make it very easy and most are not concerned about our long-range future. Together, lenders and borrowers seem to focus only on the ability to make a payment, not whether taking on more debt is wise.

The U.S. government manages our nation’s finances in much the same manner. According to a Congressional Budget Office report, in fiscal year 2019, our government spent $1.28 for every $1 of revenue it took in. Where is the wisdom in mortgaging the future of our children and grandchildren?

On a personal level, when we buy goods like a car or a home, we take on an immediate maintenance responsibility whether we choose to recognize it or not. This means we should set aside money to care for those items when needed.

It’s the same with retirement. If we plan to stop working someday, then we have a financial obligation to fund that commitment. It is not rocket science. When it comes to saving for retirement, the two most important factors are time and money. The more time we have in front of us, the less money it requires to fund retirement. If we are wise, we will start early.

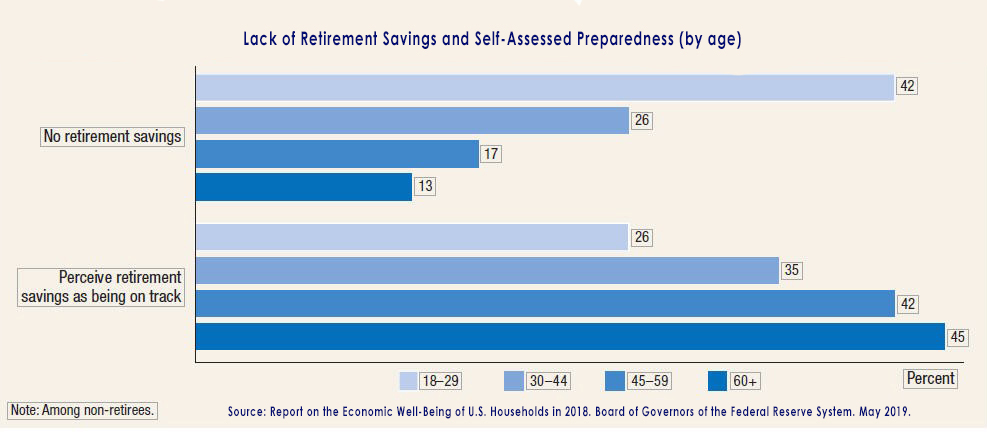

Starting to save early is a problem in our society. According to a 2019 Federal Reserve report on the economic well-being of U.S. households, in 2018, 42% of Americans between the ages of 18 and 29 (26% of those between 30 and 44) had no retirement savings.

For the Christian, financial wisdom is a matter of stewardship. Darold H. Morgan, the late president of what is now GuideStone Financial Resources, wrote: “True Christian stewardship [is] a personal response to God, growing out of one’s gratitude for God’s gift of physical life through creation and spiritual life through His gifts of grace in Jesus Christ” (Morgan, Personal Finances for Ministers, 1985, p. 25). It all starts there—recognizing the simple truth that all we have is a gift from God. “The earth is the Lord’s, and everything in it, the world, and all who live in it” (Ps 24:1 NIV).

Jesus spoke of financial wisdom in Matthew 25. In the parable, He describes a master who gave different levels of financial responsibility to three trusted stewards. Two of them made a plan, invested the assets, and doubled their value. Yes, they took some risk, but there is not much, if any, return on a risk-free investment. The third steward buried his talents in a hole in the ground. He avoided risk, but gained nothing, and drew the ire of his master, because he failed to earn even simple interest on his money.

Those of us with some history behind us should do all we can to encourage the younger generations to save for and invest in their future. Social Security will run out of funds in the next 20 years unless buoyed by lowering or deferring benefits, increasing taxes, or some combination of these actions. Unfortunately, that is yet another truth of life.

To paraphrase the words in the devotional mentioned earlier, wisdom is the skillful and practical application of the truth to the ordinary facets of life. If we are wise, we will take the “long-range view,” accept personal responsibility, and actively plan for our own financial future, because no one else is going to do it for us.

Kevin P. Gilmore serves as director of Pensions and Benefits USA for the Church of the Nazarene.